Tabby raises $160m, becomes MENA’s most ‘valuable’ fintech

Since its last funding round in October 2023, Tabby has nearly doubled its annualised transaction volume to over $10bn while maintaining profitability

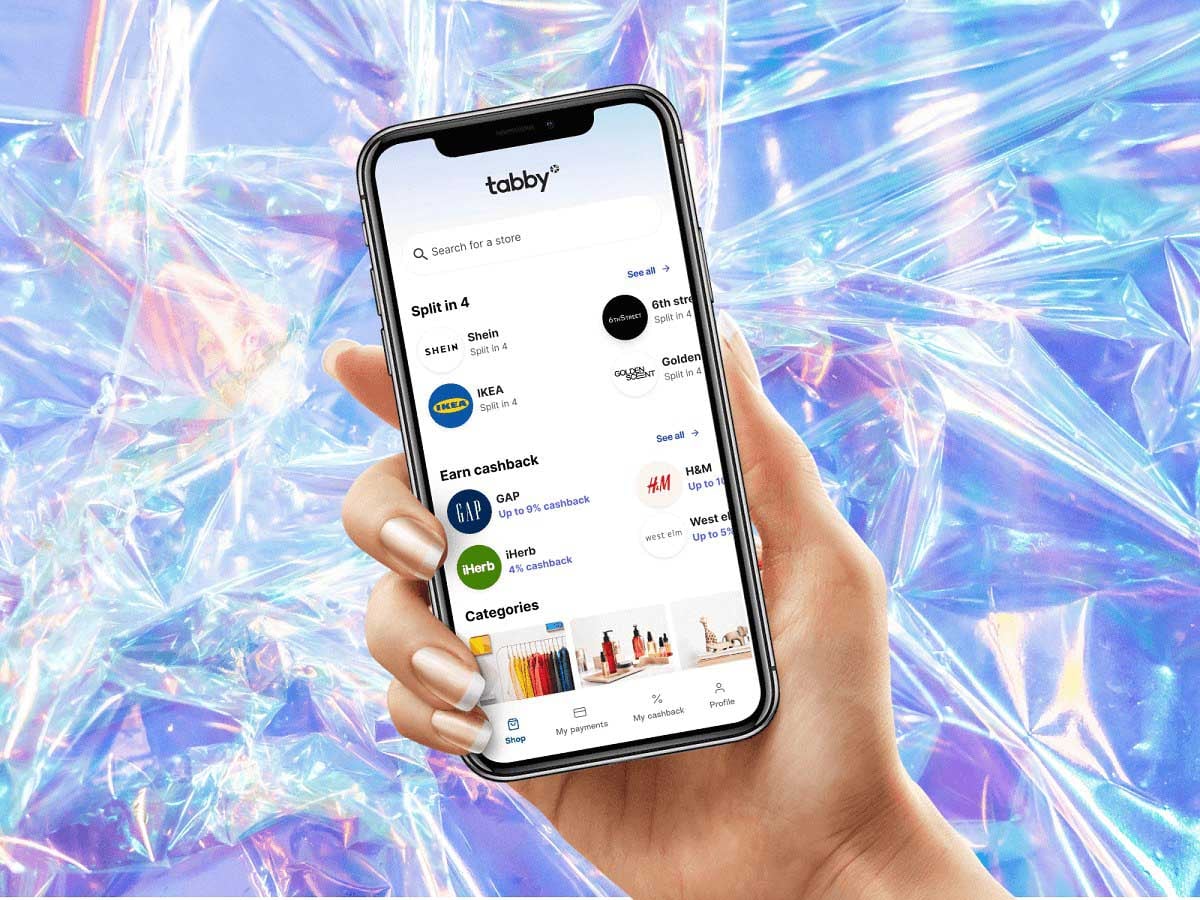

Tabby, the Middle East and North Africa’s leading financial services and shopping app, has secured $160m in a series E funding round, pushing its valuation to $3.3bn and making it the most valuable fintech company in the region.

The round was led by global investor Blue Pool Capital and Saudi Arabia’s Hassana Investment Company, with additional participation from existing backers STV and Wellington Management.

Since its last funding round in October 2023, Tabby has nearly doubled its annualised transaction volume to over $10bn while maintaining profitability.

Tabby expands product portfolio

The company has also expanded its product portfolio with the acquisition of Saudi-based digital wallet Tweeq and the introduction of new financial tools, including the Tabby Card for flexible payments beyond checkout and Tabby Plus, a subscription service. Other offerings include longer-term payment plans, Tabby Shop for deal discovery, and Tabby Care, a buyer protection programme.

The new capital will be used to accelerate the expansion of Tabby’s financial services, including digital spending accounts, payments, cards, and money management tools.

Strengthens position with upcoming IPO

The company aims to contribute to Saudi Arabia’s Vision 2030 by supporting the kingdom’s transition to a cashless economy. The financing round also strengthens Tabby’s position as it prepares for an upcoming IPO.

“This investment allows us to accelerate our rollout of products that make managing money simpler and more rewarding for our customers,” said Hosam Arab, the company’s CEO and co-founder. “We’re focused on creating tangible impact — helping people take control of their finances with tools that are accessible, effortless, and built for their everyday lives.”

Christopher Wu, chief investment officer at Blue Pool Capital, praised the company’s growth and efficiency: “Tabby’s ability to innovate and deliver exceptional products is truly impressive. Their strong revenue growth and operational efficiency set them apart from other fintech companies globally. We are incredibly excited to support the team on their mission.”

Ahmed Al Qahtani, chief investment officer for Regional Markets at Hassana Investment Company, added: “We’ve been consistently impressed with Tabby’s ability to execute and achieve such strong momentum in a short period. Their dedication to delivering innovative products and solutions to their customers reinforces our conviction in its future, and we’re thrilled to continue our partnership as they redefine financial services in the region.”

The app has more than 15 million registered users and more than 40,000 sellers, driving an annualised sales volume exceeding $10bn.

Read: Tabby’s Hosam Arab on payment trends, IPO plans and 24 Fintech

In other news, Dubai Government, represented by Digital Dubai and the Department of Finance, has integrated Tabby into DubaiPay — the unified hub for service providers and government entities. This integration enables round-the-clock deferred payment services, offering citizens, residents, and visitors in the UAE a seamless and secure way to make payments.

By introducing flexible installment options, the initiative enhances customer convenience and empowers users to manage their financial commitments more effectively.