EXCLUSIVE: Etihad CEO on growth, IPO talk and Ethiopian Airlines tie-up

Etihad Airways CEO Antonoaldo Neves tells us more about a new partnership with Ethiopian Airlines, the airline’s ambitious growth plans, record profits, and the much-speculated IPO

In this exclusive Gulf Business interview, we spoke with Etihad Airways CEO Antonoaldo Neves onboard a special flight to Addis Ababa, Ethhiopia.

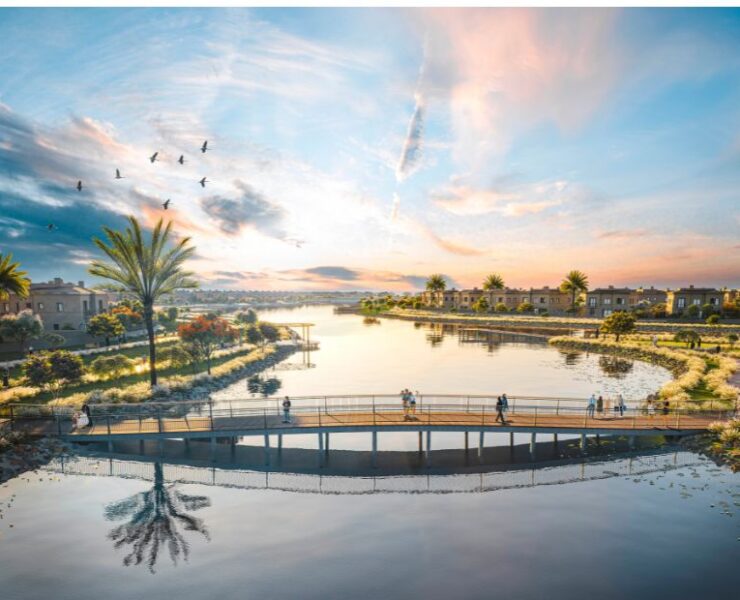

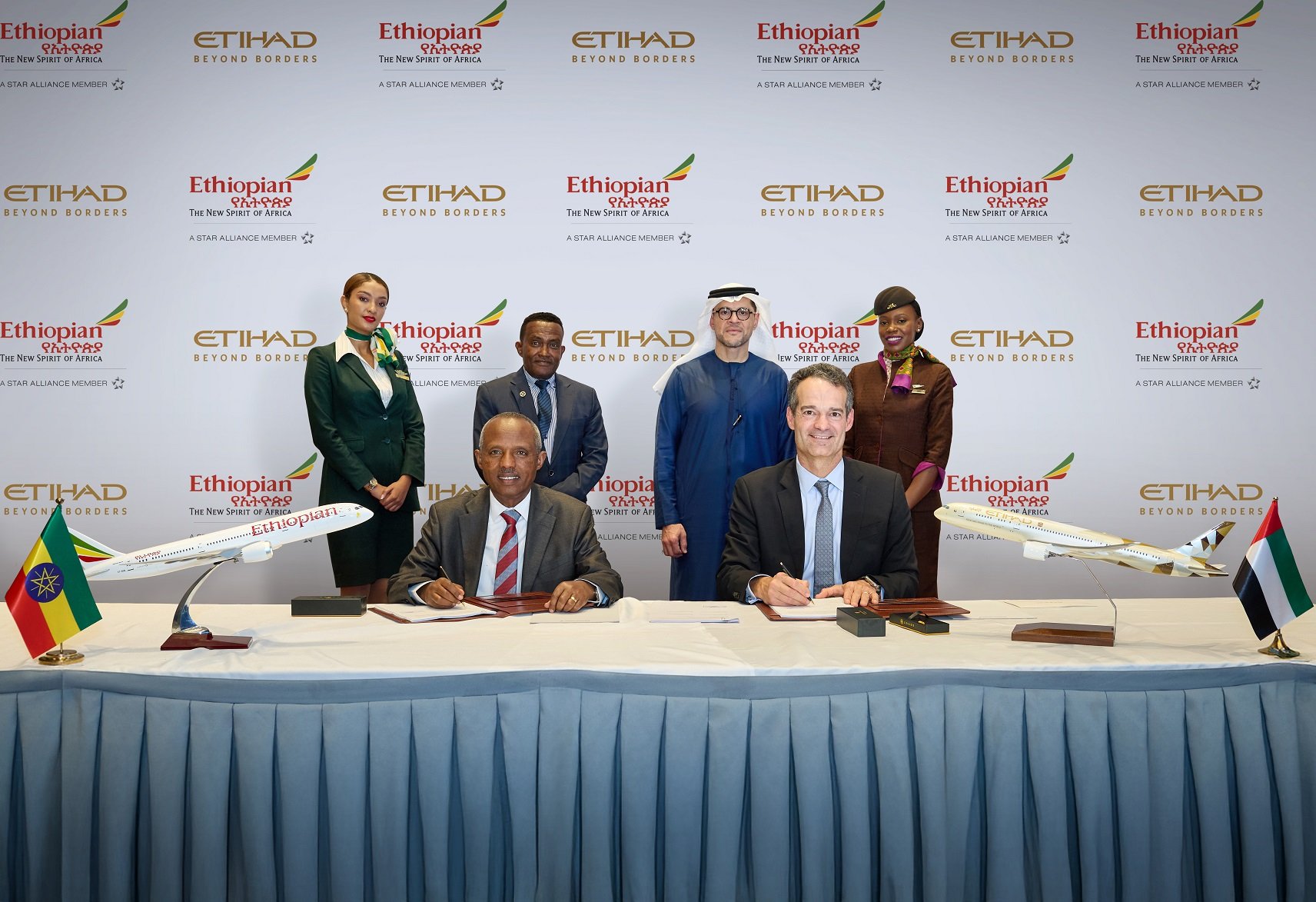

Earlier this week, Etihad Airways and Ethiopian Airlines inked a joint venture agreement that will open up a new route between Addis Ababa Bole International Airport and Abu Dhabi’s Zayed International Airport from 15 July. As part of the agreement, Etihad Airways will launch daily services to Addis Ababa from 1 October 2025.

READ MORE: Etihad, Ethiopian Airlines to launch Abu Dhabi-Addis Ababa flights

The conversation covers Etihad’s new partnership with Ethiopian Airlines, but also looks at the Abu Dhabi-based airline’s ambitious growth plans, record profits, and the much-speculated IPO.

Below is the transcript of the conversation, edited for clarity and readability.

Watch the full interview here:

We’re on this special flight with you and the Etihad Airways team to Ethiopia. Can you tell us more about what’s happening?

Etihad is working really hard to expand our partnerships across the globe. We just announced recently a very important partnership with China Eastern, which allows us to fly to China differently and provide our customers more options. And today, we’re very happy to announce that we’re going to make a very similar partnership with Ethiopian Airlines.

This is extremely important for Etihad because it means we can offer customers many more options into Africa, and at the same time, we can provide Ethiopian customers many, many options that Etihad has today to different places around the world.

And when you talk about the partnership, is it like a codeshare partnership? Can you unpack some of the logistics?

Yes, it’s a joint venture partnership. It starts with the airlines cooperating point-to-point, across about ten destinations, working together to sell and carry passengers in and out of those destinations.

Airline partnerships usually start with an interline agreement – that’s the most basic. For example, you fly Etihad (EY) and then connect on Ethiopian Airlines (ET).

Then, the partnership can evolve into a codeshare agreement, where you fly on, say, an Ethiopian plane but under the Etihad flight code.

But you can even go beyond that to a joint venture model, which is more in-depth collaboration. You provide better schedules, better pricing, seamless journeys, and all airlines share the revenue equally.

So practically, if you’re flying from Abu Dhabi to Addis, you could be on either an Etihad or Ethiopian plane, but for you as a customer, the price and experience would be the same. There’s no seat allocation restriction like in codeshare; Etihad could sell 70 per cent of seats on an Ethiopian flight and vice versa.

Why did you decide to go with the joint venture approach instead of the typical codeshare approach?

It’s a matter of speed. Traditionally, airlines go interline, get to know each other, move to codeshare, and then joint venture – a process that can take up to seven years. But there’s so much opportunity in the market now.

Both Etihad and Ethiopian have strong organisational capabilities. If it’s better for both sides, why not do it sooner?

This approach benefits Etihad, Ethiopian, and most importantly, the customers. So, we decided to fast-track it.

Ethiopian Airlines has grown in leaps and bounds recently. It’s now a central hub for African aviation. Abu Dhabi, of course, is also central. Does this give you two hubs from which you can operate globally?

Exactly. You’ve got to admire your counterpart. Ethiopian has built something amazing. They’re about the same size as Etihad, and they provide very good service.

We’re partnering with an airline that shares our view on how an airline should be run and how to develop the future of aviation. Their A350s are amazing, and we believe this is a milestone for the industry.

Etihad will benefit from their network, and in the past three years, we’ve doubled our size – growing from 10 million to 21 million passengers this year.

No other airline in the Middle East provides the frequency we do to the Middle East and India. Customers value frequency.

Now, we’re flying four times a day to multiple markets. Three years ago, we didn’t have that. We’re focused on convenience and providing multiple flights daily to key markets.

And in terms of the number of destinations you serve – it’s grown significantly too?

Yes, but two-thirds of our growth is adding capacity to existing markets, not just new destinations.

Two years ago, we had 15 destinations with more than two flights a day. Today, we have over 40. For example, four flights daily to Kuwait.

We’ll keep opening 10-15 new destinations yearly – Addis Ababa is our 15th this year. But equally important is increasing frequencies in markets we already serve.

Customers value not just price but the ability to fly when they want, with short connections and reliable service.

Talking about the region, the GCC aviation sector seems to be experiencing a golden age. Your neighbour Dubai is seeing record traffic. Is this growth unstoppable?

Absolutely. Airline growth is always correlated to GDP growth, and the Middle East is still underserved.

Within a four-hour flight from Abu Dhabi, you have two billion people. For comparison, Brazil has 250 million people. So, the opportunity is massive.

GDP in the region grows about 5 per cent annually, and aviation typically grows twice that.

Other airlines are growing at 3-4 per cent. Etihad will grow 15 per cent this year.

Why? Because we have the capacity at Abu Dhabi Airport, one of the best terminals globally. You have a 99 per cent chance of not taking a bus to board, no trains to gates, pre-clearance to the US – all advantages.

Looking further ahead, there’s been talk about Riyadh Air. Do you see them as a positive force, or will competition heat up?

They’re not flying yet. It’ll take years to reach critical mass.

I’ve seen this before. It took David Neeleman seven years to get Breeze Airways to scale.

That said, I welcome competition. There are many airlines in the region – Saudia, Air Cairo, Wizz Air Abu Dhabi, Flynas – all excited about the market.

Increased competition stimulates the market. The challenge isn’t just about product; anyone can offer good seats or food.

It’s about having a reliable, scalable network that makes money while providing excellent service. Few can master all of that.

Coming back to Etihad, you’ve reported record profits, passenger numbers, routes – and there’s talk of a potential IPO. What can you tell us?

The speculation is natural. If we weren’t doing well, there’d be no talk. Margins have improved, profitability is up, but we stay humble – there’s still room for growth. ADQ, our shareholder, has listed companies before, so it’s understandable there’s talk.

IPO is a tool, not an end. I’ve been through IPOs before. Airlines are capital-intensive and need flexibility. Our job is to be ready if the shareholder decides to proceed. Operationally, financially, from a governance standpoint – Etihad is ready. But no decision has been made yet. We take the speculation as a compliment, a sign we’re on the right path. If the day comes, we’ll be ready.